Article's Content

The VP of Marketing knows something is broken.

Pipeline is unpredictable, sales is frustrated, and the CEO is asking harder questions about ROI.

She doesn’t start with Google.

She opens ChatGPT.

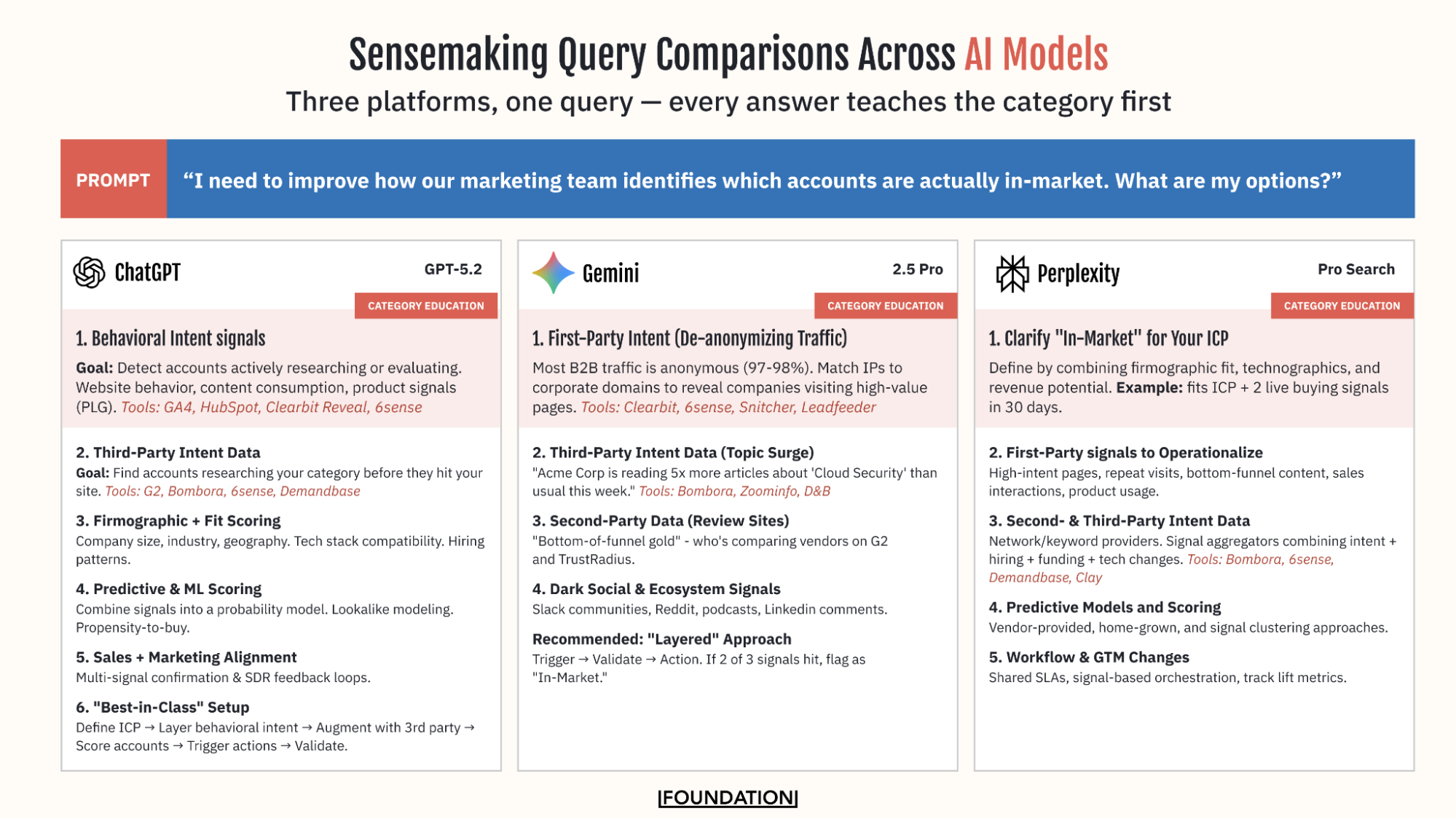

“I need to improve how our marketing team identifies which accounts are actually in-market. What are my options?”

She doesn’t know whether this is an intent data problem, an ABM problem, or something else entirely. Before evaluating vendors, she needs to understand the problem and the category itself.

She’s not the only executive doing this.

According to the G2 2025 Buyer Behavior Report, 30% of buyers now start with AI before Google, and 47% use AI for market research and discovery. In enterprise segments, AI and review sites have overtaken traditional search as primary research sources.

The earliest stage of the B2B buying journey, when buyers define their problem and map the solution landscape, is moving upstream into conversational AI.

And that shift changes who makes the shortlist.

For B2B Buyers, AI is More Sensemaker Than Decisionmaker

When an enterprise decisionmaker has a problem they don’t fully understand, the traditional B2B buyer journey is long. Over weeks or months, they piece together an understanding of what category of solution exists, what the key criteria are, and who the major players are.

AI compresses that educational phase into a single conversation. A buyer can move from “I have a problem” to “Here are the solution categories, evaluation criteria, and major vendors” in minutes.

It doesn’t replace the buying journey, but it condenses the initial orientation that used to span dozens of touchpoints into a single pre-journey moment. And that moment has a name.

The Sensemaking Function

Sensemaking is what you do before you act.

It’s how you reduce complexity, connect scattered signals, and form a working model of what’s happening. In B2B buying, that means defining the problem, understanding solution types, and identifying evaluation criteria.

And that early orientation is durable. According to 6sense’s 2025 B2B Buyer Experience Report, 95% of buyers ultimately purchase from a vendor on their Day One shortlist. Once buyers decide who belongs in the conversation, very few new names enter it.

AI now sits upstream of that moment — 37% of consumers now start searches with AI instead of Google). Increasingly, it frames the category before buyers ever visit a vendor website.

So, what does this sensemaking moment actually look like? And how does it change across models?

We ran a quick experiment by running the exact same prompt through ChatGPT, Gemini, and Perplexity. The pattern was consistent: each model explained the category first, then introduced vendors like 6sense and Demandbase.

(To save you from reading tiny screenshot text on a screen, here’s a breakdown of the responses by three leading AI tools to the same prompt.)

This progression highlights an important distinction.

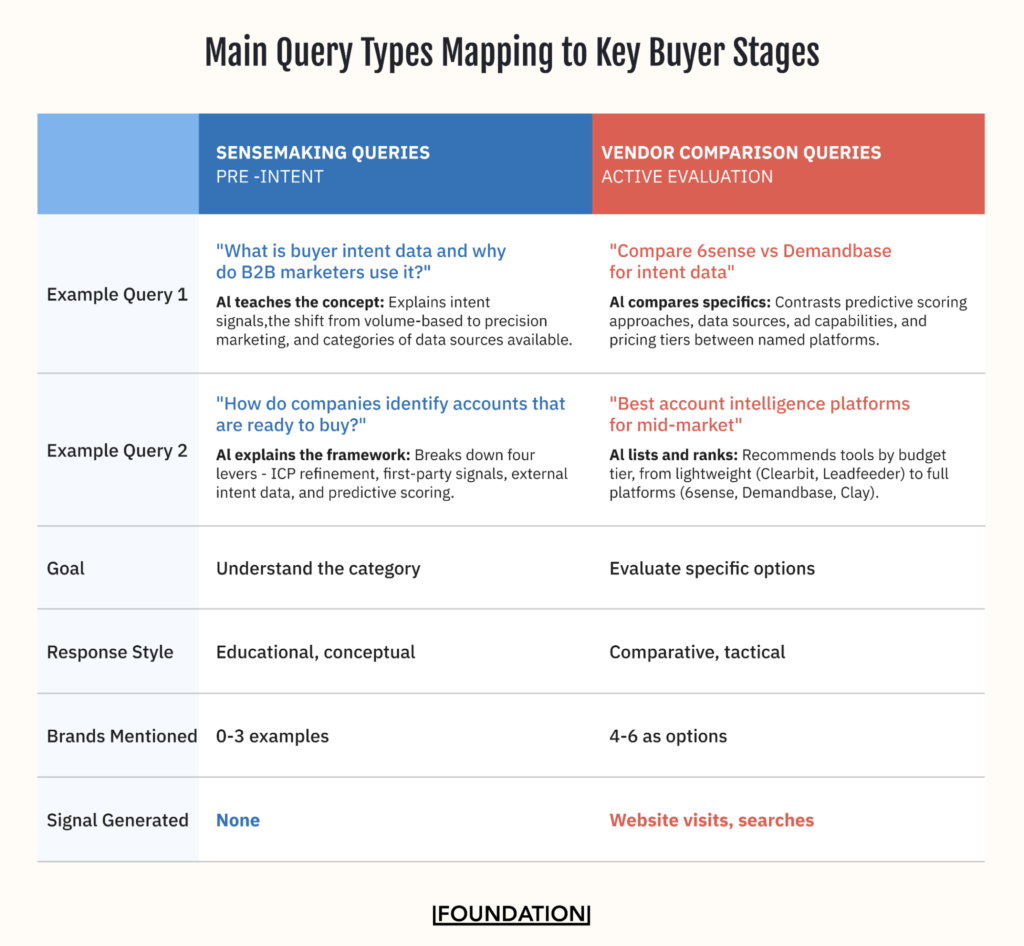

When a buyer asks AI, “What is buyer intent data?”, they’re building a mental model. When they ask, “Which tool is better at analyzing intent data, 6sense or Demandbase?” , they’re evaluating.

The first is sensemaking.

The second is comparison.

AI shapes the first stage — and that’s the stage that determines who makes the shortlist.

| The takeaway: AI teaches categories before it names vendors. If your brand isn’t part of how AI explains your category, you may never make the Day One shortlist. |

AI Isn’t Changing How Buyers Choose. It’s Changing Who They Choose Between.

Sensemaking and vendor evaluation happen at different stages of the buying journey. AI compresses the first stage, but it doesn’t eliminate the second.

The 6sense 2025 B2B Buyer Experience Report, drawing on nearly 4,000 buyer responses globally, confirms that the core dynamics of B2B buying are stable:

- Vendor contact hasn’t declined — buyers still interact with the winning vendor around 16 times before purchasing.

- Buying groups take time forming preferences — 94% rank their shortlist before engaging sellers.

- Buyers contact their preferred vendor first — 95% of the time, the winning vendor is already on the buyer’s Day One shortlist.

Plus, when buyers do initiate contact, they reach out to their top-ranked vendor first — and that vendor wins the deal roughly 80% of the time. In other words, buyers have already identified a favourite and are reaching out to confirm.

What has changed is the preparation that precedes the purchase. By the time buyers talk to sales, their research has framed the category, the criteria, and the shortlist.

So if buying behavior remains largely unchanged, why does this early sensemaking layer matter?

| The takeaway: Buyers don’t skip evaluation. But they evaluate from a narrow, pre-ranked shortlist. By the time sales gets involved, the real filtering has already happened. |

Understanding the Early Decision-Making Window: Legitimacy vs. Preference

Two psychological thresholds shape every B2B buying journey: legitimacy and preference.

- Legitimacy: “Does this vendor belong in the conversation?”

- Preference: “Which vendor is best for us?”

AI is increasingly influencing the first question.

As we’ve seen, most buyers purchase from their Day One shortlist. That shortlist reflects who they’ve already deemed legitimate. Once a vendor is excluded from that mental model, very few new names enter consideration.

And what signals legitimacy earlier than being named in an AI response while a buyer is first learning about a category?

If you’re not surfaced in that moment, you’re not competing. AI may not decide who wins, but it increasingly determines who gets considered.

The Cost of Absence

Brands that don’t appear in the sensemaking phase aren’t actively rejected. It’s worse than that — they simply don’t exist for the buyer.

Only 5% of buyers stray from their Day One shortlist. Once legitimacy is established, inclusion is durable.

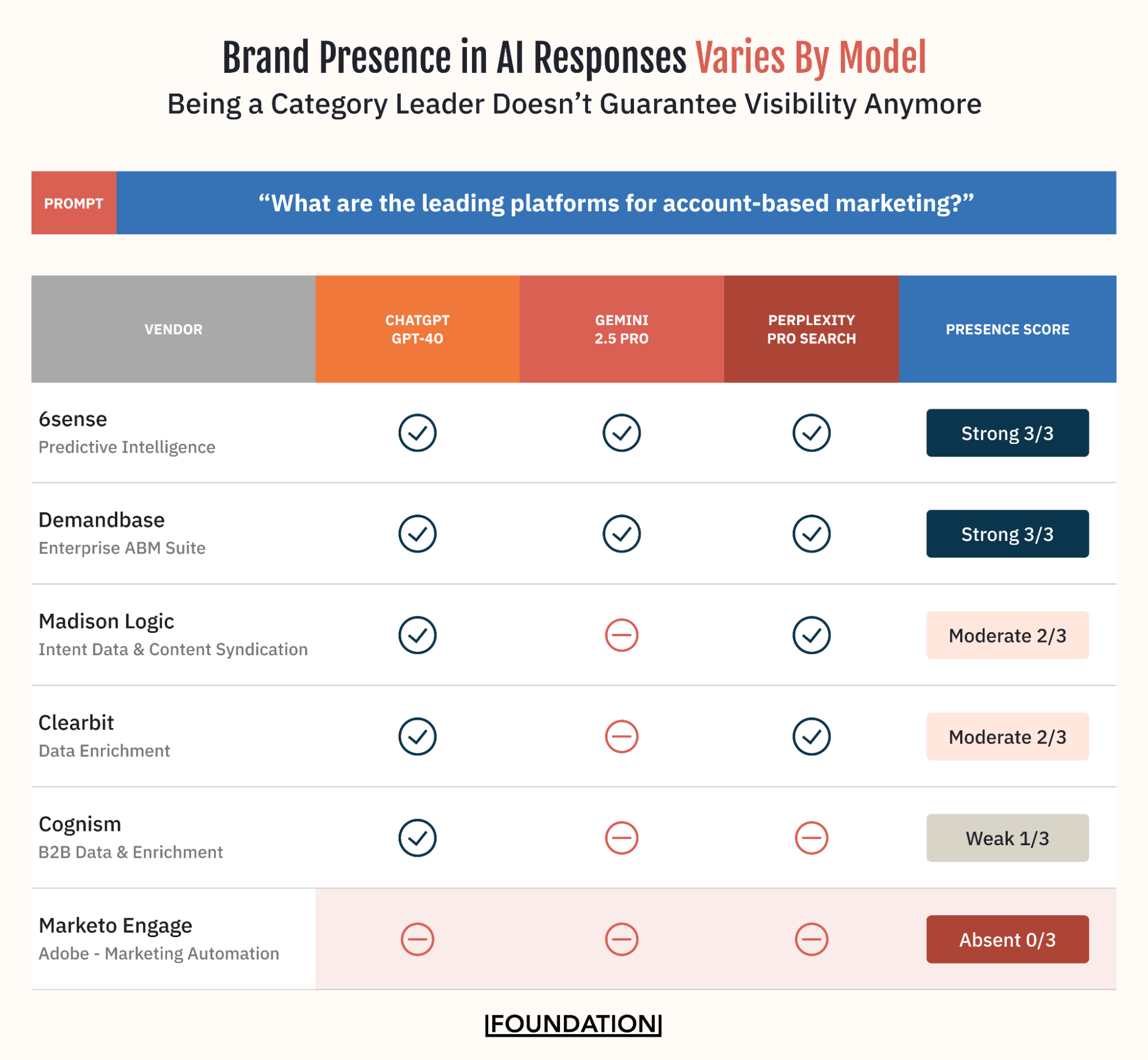

To illustrate this, we ran another query for our hypothetical VP or marketing across the same three major AI platforms: “What are the leading platforms for account-based marketing?”

The results varied. 6Sense and Demandbase appeared consistently. Marketo Engage, which Adobe acquired back in 2018 as part of a $4.75 billion deal, did not appear at all.

AI visibility isn’t uniform. Models draw from different ecosystems, which means vendor inclusion varies by platform. But the pattern is clear: brands that appear consistently are present across the broader information landscape — review sites, communities, educational content — not just their own websites.

| The takeaway: AI determines who appears legitimate at the moment buyers form their shortlist. Absence is exclusion. |

The Window for Establishing Legitimacy Is Shrinking

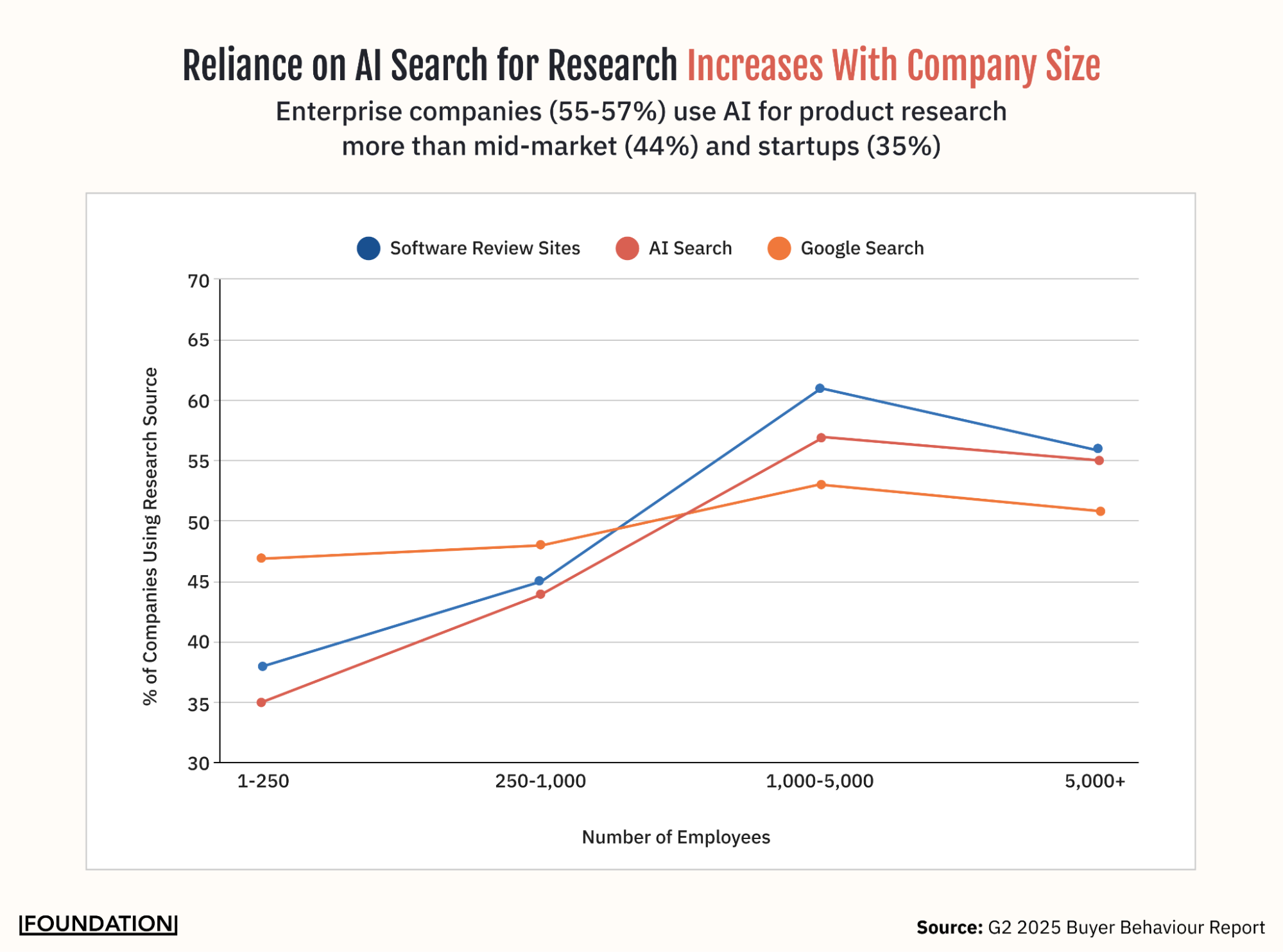

The shift is being led by the largest buyers.

Among companies with fewer than 250 employees, Google is still the primary product research source. 47% of companies in this segment report using Google, compared to 35% that use AI search.

But as organizations scale, AI overtakes traditional search. At 1,000–5,000 employees, AI usage surpasses Google.

At 5,000+ employees, AI and Google are nearly tied, with 55% and 51% of companies using them, respectively. At that level, software review sites edge out both, used by 56% of companies. AI may frame the category, but review sites reinforce credibility.

This means enterprise buying groups running six- to seven-figure evaluations are using AI to form their initial understanding of a category — often before visiting a vendor website.

And the broader buying environment is tightening.

- Shortlists are shrinking. Most buyers now evaluate 2–3 vendors, down from 4–5.

- AI is compressing evaluation. 38–43% of buyers already use AI to evaluate and shortlist vendors.

- Buying cycles are shorter. The average cycle dropped from 11.3 to 10.1 months, with first vendor contact happening 6–7 weeks sooner.

Taken together, the implication is straightforward: fewer slots, earlier decisions, less time to earn inclusion.

| The takeaway: AI adoption is rising, shortlists are shrinking, and legitimacy is established earlier than ever. Brands have fewer opportunities to enter consideration — and once excluded, recovery is rare. |

“Invisible” Conversations and the Attribution Problem

The harder truth isn’t just that AI shapes early opinion. It’s that enterprise buyers are forming category opinions in environments your team doesn’t control and can’t easily measure.

Buyers ask questions privately, in conversational interfaces, and the entire interaction may happen before problems are articulated clearly enough for Google queries or website visits.

This creates a fundamental gap in the B2B marketing toolkit. Traditional intent signals — the entire infrastructure of website analytics, content engagement tracking, and third-party intent data — only activate once buyers are past the sensemaking phase. By the time an account “lights up” in your intent platform, the mental model has already formed.

This is something our VP of Strategy, James Scherer, mentioned during a discussion on the ROI of generative engine optimization (GEO):

“GEO operates in zero-click environments like ChatGPT, AI Overviews, and Reddit threads and you can’t track user behavior on platforms you don’t own. Multi-touch attribution breaks down when the ‘touch’ happens outside your ecosystem.”

You can see when buyers leave — declining web traffic is well-documented thanks to AI summaries, particularly at the top of the funnel. But you can’t see where they’re going, what they’re learning, how they’re forming opinions, or who they’re considering.

So, now the question is…

What Does the New AI Buyer Journey Mean for B2B Brands?

Increasing AI visibility through GEO is different from optimizing a new channel or gaming an algorithm update. It’s a comprehensive shift in strategy based on the understanding that the earliest moments of opinion formation are moving — and understanding what that means for how brands establish legitimacy.

Here are four ways you need to change your thinking around B2B buying in an AI-facilitated landscape:

1. Redefine “Early Funnel”

Before, “early” meant the top-of-funnel awareness stage where focus is on demand capture. Now it means shaping category understanding and getting your name in the AI-generated shortlist. Think mental model formation, category framing, problem-space education.

2. Reposition Content Around Category Ownership

The content that shapes buyer interactions is now being filtered through AI systems first. Buyers still need 16+ vendor interactions — but the lens through which they evaluate those interactions is set during the sensemaking phase.

This means shifting from “what we do” content (product-first positioning, competitor comparison pages) toward “what this category is” content (problem-space education, category definition and framing, content that AI can learn from and synthesize).

3. Accept That Influence ≠ Attribution

Impact in the sensemaking doesn’t show up in marketing dashboards. Early legitimacy determines who makes that list — and the mechanisms that build that legitimacy are increasingly invisible to traditional measurement. Success metrics need to shift from “did we get the click?” to “are we part of the conversation?”

4. Compete for Inclusion

AI-assisted buying shifts the battleground upstream. Before buyers decide who is best, they decide who belongs. That inclusion threshold is becoming the primary competitive frontier. And many important brands are still being filtered out at this stage.

| The takeaway: The shift to AI-first research changes where growth is won. Invest upstream, in category authority, ecosystem presence, and legitimacy, before the shortlist forms without you. |

Get On the Shortlist Before the Journey Starts

95% of buyers purchase from their Day One shortlist. And that shortlist is increasingly being shaped by AI conversations your marketing team can’t see, can’t track, and can’t influence with a better Google ranking.

Now let’s return to that VP of Marketing.

She’s sitting in ChatGPT, trying to understand how companies like hers identify in-market accounts. She doesn’t know it yet, but the mental model she builds in this conversation will shape every downstream decision — which vendors feel legitimate, which criteria seem important, which solutions she’ll eventually evaluate.

Get in touch with the leading AI visibility and generative engine optimization agency today to get your name on her shortlist.